Commercial fuel distribution operations face unique logistical challenges that distinguish petroleum delivery from general freight transportation, with hazmat regulatory compliance, time-sensitive delivery windows, specialized equipment requirements, and the high-value cargo nature of fuel creating operational complexity requiring sophisticated dispatch management. The average fuel distributor operates with 8-12% operating margins, meaning that dispatch efficiency improvements of even 2-3% translate directly to substantial profitability gains when multiplied across thousands of annual deliveries. Understanding how to optimize fuel dispatching requires knowledge extending beyond basic route planning to encompass DOT Hours of Service compliance, compartmentalized load optimization, customer tank monitoring integration, and dynamic rerouting responding to demand fluctuations that can occur throughout operating days.

Understanding Fuel Distribution Operating Economics

Fuel dispatching economics differ fundamentally from general freight, with fuel representing high-value, low-margin cargo where delivery costs must remain minimal relative to product value to maintain profitability. Diesel fuel averaging $3.50/gallon means a 9,000-gallon tanker load carries approximately $31,500 in product value, yet typical delivery costs driver wages, truck operating expenses, overhead allocation range from $180-280 per delivery depending on distance and dwell time.

Cost Components in Fuel Distribution:

| Cost Category | Percentage of Operating Cost | Optimization Opportunity |

|---|---|---|

| Driver compensation | 35-40% | Route efficiency reducing hours worked |

| Fuel consumption | 20-25% | Route optimization, idle time reduction |

| Vehicle maintenance | 15-18% | Preventive maintenance, appropriate vehicle selection |

| Insurance/regulatory | 10-12% | Safety record improvement, compliance automation |

| Administrative overhead | 8-10% | Dispatch automation, customer portal adoption |

The per-delivery cost structure creates strong incentives for multi-drop routing where single trucks deliver to multiple customers along optimized routes rather than dedicated runs to individual locations. However, this requires sophisticated load planning ensuring that compartmentalized tankers carry the correct fuel grades in appropriate quantities matching each customer’s order while maintaining delivery sequence that doesn’t require breaking compartment seals prematurely.

Delivery time windows imposed by customers particularly retail fuel stations that require deliveries during overnight hours when traffic impacts minimal and fuel sales slow allowing tank filling constrain routing flexibility. A dispatcher might identify an optimal geographic route sequence, but if customer delivery windows don’t align with that sequence, the theoretical efficiency becomes operationally impossible to achieve.

Regulatory Compliance and Safety Management

Fuel distribution operates under extensive DOT and EPA regulations governing both the hazardous materials being transported and the commercial vehicle operations conducting transportation. Federal Motor Carrier Safety Regulations (FMCSR) Part 397 establishes hazmat transportation requirements including routing restrictions, driver training mandates, and emergency response planning that dispatchers must account for when planning routes and selecting drivers.

Critical Regulatory Compliance Elements:

- Hours of Service (HOS): 11-hour driving limit within 14-hour on-duty window, mandatory 30-minute break, 70-hour weekly limit

- Hazmat Endorsement: CDL with tank vehicle and hazmat endorsements required for drivers, with TSA security threat assessment

- Routing Requirements: Must use preferred hazmat routes, avoid residential areas where possible, document route selections

- Placarding/Documentation: Proper hazmat placards, shipping papers, emergency response information required

- Vehicle Inspection: Pre-trip and post-trip inspections documented, annual inspection certification maintained

Electronic Logging Device (ELD) mandates since 2017 automated HOS tracking, creating both compliance benefits and dispatch complications as systems now prevent drivers from exceeding legal driving hours even when manual log manipulation previously occurred. This electronic enforcement requires dispatchers planning routes that fit within available driving hours rather than optimistic schedules assuming drivers will exceed limits to complete deliveries.

The driver shortage affecting trucking generally impacts fuel distribution particularly acutely, as hazmat endorsements, clean driving records, and local knowledge required for fuel delivery narrow the already-limited driver pool. This constraint makes driver schedule optimization through efficient dispatching critical, as overworked drivers leave for competitors offering better work-life balance even when compensation remains similar.

Dynamic Demand Management and Inventory Optimization

Fuel consumption patterns fluctuate based on factors including weather, economic activity, seasonal demand, and even gasoline price psychology where consumers adjust purchasing behavior based on whether prices trend upward or downward. Dispatch optimization requires integrating demand forecasting with delivery scheduling, ensuring customers receive deliveries before running low while avoiding overfilling tanks that might not have capacity for full loads.

Tank monitoring systems using gauge readings or telemetry provide real-time inventory data allowing just-in-time delivery scheduling rather than fixed-interval deliveries regardless of actual consumption. A retail station historically receiving deliveries every 72 hours might actually need delivery in 60 hours during peak travel weekends but can extend to 96 hours during slow periods, with dynamic dispatching adjusting schedules accordingly.

Demand Variability Factors:

- Seasonal patterns: Summer driving season increases gasoline demand 15-20%, winter heating oil demand peaks in northern climates

- Weather events: Impending storms trigger panic buying, while severe weather reduces consumption

- Economic conditions: Recession reduces commercial fuel demand, though consumer gasoline proves relatively inelastic

- Price trends: Rising prices trigger inventory building, falling prices encourage delaying purchases

- Special events: Major sporting events, holidays, local festivals create localized demand spikes

Emergency delivery requests from customers who miscalculated inventory or experienced unexpected demand spikes create dispatch complications, as these unplanned deliveries disrupt optimized routes while potentially requiring overtime or weekend delivery at premium costs. Some distributors charge premium pricing for emergency deliveries, though customer relationship considerations often limit aggressive surcharging despite the real costs involved.

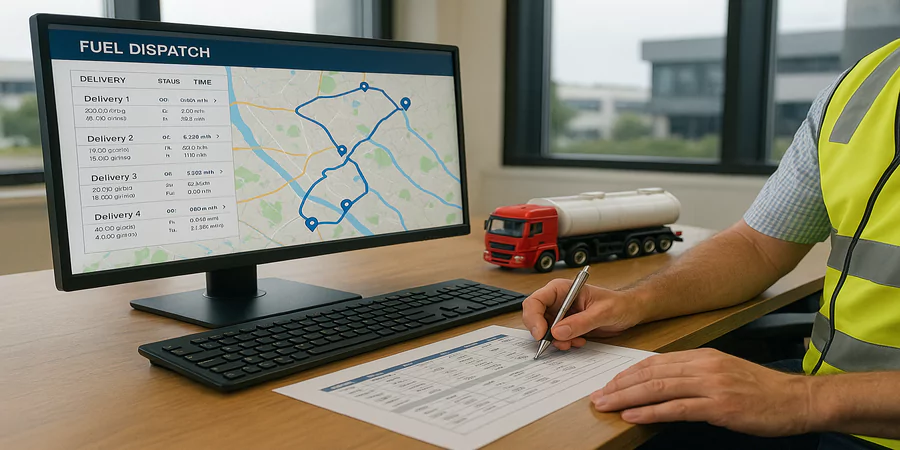

Route Optimization Technology and Implementation

Modern route optimization software employs algorithms considering dozens of variables simultaneously customer locations, delivery windows, product requirements, truck capacity, driver hours, traffic patterns, road restrictions to generate routes that manual dispatchers cannot match in efficiency. These systems can reduce total route miles by 10-20% compared to manual dispatching while improving on-time delivery rates and driver schedule predictability.

Route Optimization Software Capabilities:

- Multi-objective optimization: Balances competing goals like minimizing miles, meeting time windows, evening driver workloads

- Dynamic rerouting: Responds to real-time traffic, road closures, weather conditions, or new emergency deliveries

- Load planning: Optimizes compartment loading sequences ensuring products available when needed along route

- Driver preference consideration: Accounts for driver familiarity with routes, customer relationship history

- Historical learning: Analyzes past route performance improving future optimization accuracy

Implementation challenges include data quality requirements accurate customer addresses, realistic service times, current traffic patterns that manual operations often lack. A system optimizing based on incomplete or inaccurate data produces suboptimal routes that reduce user confidence in the technology, creating resistance to adoption that undermines optimization benefits.

Change management proves equally important as the technology itself, as experienced dispatchers resistant to systems perceived as replacing their expertise can sabotage implementation through non-compliance or highlighting system failures while ignoring efficiency gains. Successful implementations position optimization software as tools enhancing dispatcher capabilities rather than replacements, with human oversight correcting algorithmic decisions that miss situational context computers don’t understand.

Fleet Management and Vehicle Utilization

Fuel distribution fleets typically operate specialized equipment compartmentalized tankers ranging from 2,500-gallon straight trucks serving remote locations to 9,000-gallon semi-tankers handling high-volume deliveries with vehicle selection for specific routes significantly impacting efficiency. Sending a large tanker to deliver small quantities wastes capacity, while undersized vehicles force multiple trips when single deliveries would suffice.

Equipment age and maintenance status directly affect dispatch reliability, as breakdowns force last-minute route reassignments creating inefficiencies that ripple through daily operations. Preventive maintenance scheduling coordinated with dispatch planning performing service during slow periods, maintaining spare equipment for coverage minimizes disruptions while extending vehicle lifespans that represent substantial capital investments.

Fleet Composition Strategy:

- Large semi-tankers (8,000-9,000 gallons): Highway-accessible high-volume accounts, bulk plant deliveries, long-distance routes

- Medium tankers (5,000-6,000 gallons): Mixed urban/suburban routes, customers with moderate consumption

- Small straight trucks (2,500-4,000 gallons): Congested urban areas, customers with limited access or lower volumes

- Specialty equipment: DEF haulers, aviation fuel trucks, hazmat emergency response vehicles

Vehicle allocation to specific routes should consider not just capacity matching but also equipment condition, with newer, most reliable trucks assigned to longest or most critical routes where breakdowns create maximum disruption. Older equipment might serve local routes where breakdowns cause minimal impact and quick recovery remains possible.

Fuel efficiency of the fleet itself matters when distributing fuel, creating somewhat ironic situations where inefficient delivery vehicles consume excessive amounts of the product being delivered. Modern tankers with aerodynamic improvements, automatic transmissions, and efficient engines consume 15-20% less fuel than older equipment, with these savings directly improving profitability over vehicle lifespans.

Customer Communication and Technology Integration

Modern fuel distribution increasingly involves customer-facing technology enabling customers to monitor their own inventory, schedule deliveries online, and receive real-time delivery tracking rather than relying on phone calls to dispatchers. These portal systems reduce administrative workload while improving customer satisfaction through transparency and control.

However, technology adoption varies dramatically across customer segments, with large commercial accounts embracing automated systems while small retail operators prefer phone-based ordering. Dispatch operations must accommodate both approaches without creating inefficiency, such as by maintaining specific time windows for phone order processing rather than accepting calls throughout the day that constantly disrupt planned routes.

Automated tank monitoring with supplier integration represents the ultimate efficiency, where telemetry systems automatically generate delivery orders when customer inventory reaches predetermined thresholds, with dispatchers simply optimizing routes for system-generated orders rather than managing order intake separately. This approach requires upfront investment in monitoring equipment but dramatically reduces both customer and supplier administrative burden.

Measuring Performance and Continuous Improvement

Effective dispatch optimization requires tracking key performance indicators demonstrating whether changes actually improve efficiency versus simply rearranging operations without meaningful impact. Metrics should capture both operational efficiency and customer service quality, as pure cost optimization that degrades service creates long-term problems outweighing short-term savings.

Critical Dispatch KPIs:

- Cost per delivery: Total operating costs divided by deliveries completed (target: declining trend over time)

- Miles per delivery: Average route miles per delivery completed (lower indicates better geographic clustering)

- On-time delivery rate: Percentage of deliveries within customer time windows (target: >95%)

- Driver utilization: Percentage of available driver hours productively employed (target: 85-90%)

- Emergency delivery percentage: Unplanned deliveries disrupting optimized routes (target: <5% of total volume)

Benchmarking against industry standards helps identify whether your operation performs competitively, though obtaining reliable comparative data proves challenging as most distributors guard operational metrics. Industry associations sometimes publish aggregate data providing general guidance about typical performance ranges.

Continuous improvement processes reviewing performance data weekly or monthly, identifying recurring inefficiencies, and testing solutions create cultures where optimization becomes ongoing practice rather than one-time project. The operations achieving greatest efficiency gains maintain formal improvement programs with cross-functional teams analyzing data and implementing changes systematically.

Successful fuel dispatching optimization balances competing objectives of cost minimization, service quality maintenance, regulatory compliance, and driver satisfaction, requiring sophisticated management approaches that simple cost-cutting cannot achieve while building sustainable competitive advantages through operational excellence.

Related: How Strategic Truck Investments Can Boost Your Logistics Operations